A Deep Dive into the Finance Modules of MS Dynamics 365 Business Central

Nick | 17 Mar 2024 | 5 Mins Read

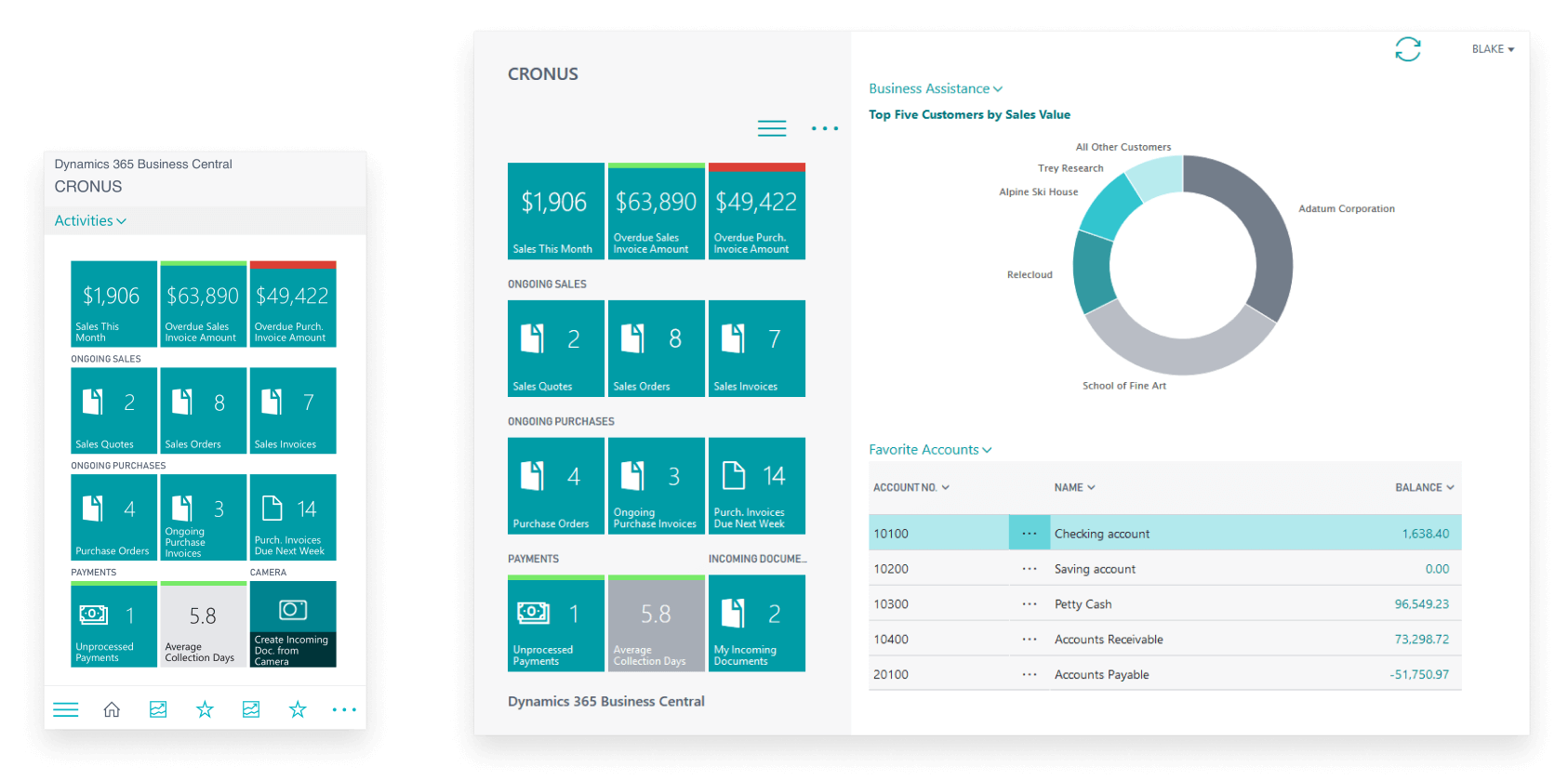

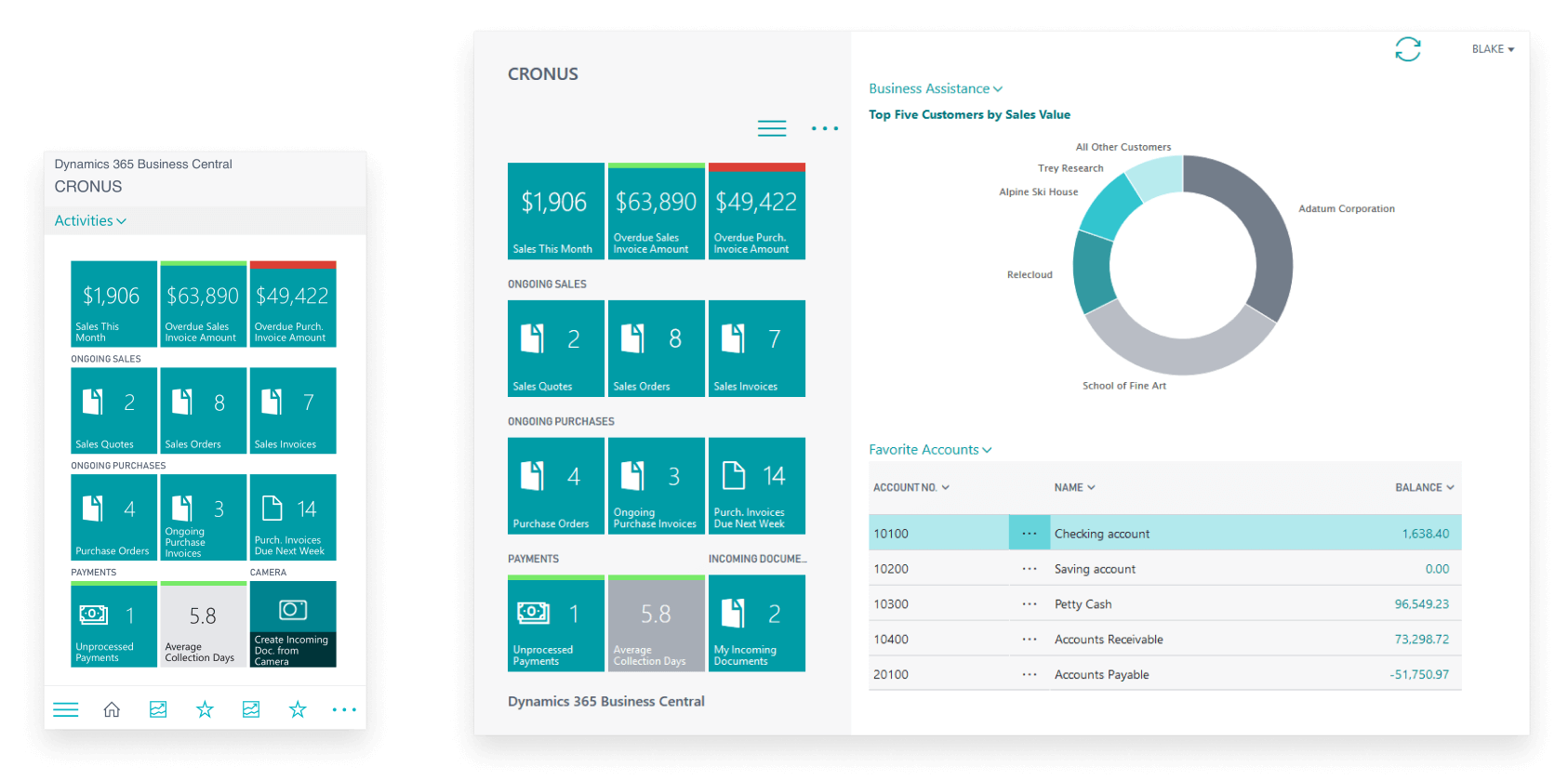

In the realm of small and medium-sized businesses (SMBs), financial control is paramount for success. Every decision, from budget allocation to investment strategies, hinges on having accurate and up-to-date financial information. This is where MS Dynamics 365 Business Central steps in, offering a suite of powerful finance modules tailored to meet the unique needs of SMBs. Let's delve into these modules and explore how they can empower your business to master financial control.

Understanding the Finance Modules:

- General Ledger: The backbone of your financial operations, the General Ledger module in MS Dynamics 365 Business Central provides a centralized platform for recording all financial transactions. From accounts payable and receivable to bank reconciliations, it ensures accuracy and transparency in your financial data.

- Accounts Payable: Streamline your vendor management processes with the Accounts Payable module. Track and manage invoices, automate payment schedules, and maintain vendor records efficiently. By optimizing your accounts payable workflows, you can enhance cash flow management and strengthen supplier relationships.

- Accounts Receivable: Accelerate your cash flow cycle and improve customer relationships with the Accounts Receivable module. Easily generate invoices, manage customer payments, and track outstanding balances in real-time. With automated invoicing and payment reminders, you can reduce delays and minimize the risk of bad debt.

- Cash Management: Gain better control over your cash flow and liquidity with the Cash Management module. Monitor bank balances, reconcile accounts, and forecast cash flow projections with ease. By staying on top of your cash position, you can make informed decisions and seize opportunities for growth.

Benefits for SMBs:

- Increased Efficiency: By automating routine financial tasks and eliminating manual data entry, MS Dynamics 365 Business Central streamlines your financial processes, saving time and reducing errors.

- Improved Accuracy: With real-time visibility into your financial data, you can make more accurate forecasts and decisions, minimizing the risk of costly errors and financial discrepancies.

- Enhanced Compliance: Stay compliant with regulatory requirements and industry standards effortlessly. MS Dynamics 365 Business Central ensures that your financial operations adhere to legal and audit standards, reducing the risk of penalties and fines.

- Better Financial Insights: Leverage advanced reporting and analytics tools to gain actionable insights into your financial performance. Identify trends, spot opportunities, and mitigate risks proactively, empowering you to drive business growth and profitability.

How iShore Software Solutions Can Help:

As a trusted Microsoft Dynamics company, iShore Software Solutions specializes in implementing and customizing MS Dynamics 365 Business Central for SMBs. Our team of experts has the knowledge and experience to tailor the finance modules to suit your unique business needs, ensuring a seamless integration and maximum return on investment.

From initial consultation and implementation to ongoing support and training, iShore Software Solutions is committed to helping SMBs master financial control with MS Dynamics 365 Business Central. Ready to take control of your finances and unlock growth opportunities? Contact us today to learn more about how we can assist you on your journey to financial success.

Request a Quote Today

for Exceptional Services & Solutions!

Looking for top-notch Services & Solutions at competitive prices? Request a quote today and experience the excellence our team has to offer. Don't miss out on this opportunity!

Request a Quote Schedule a Meeting